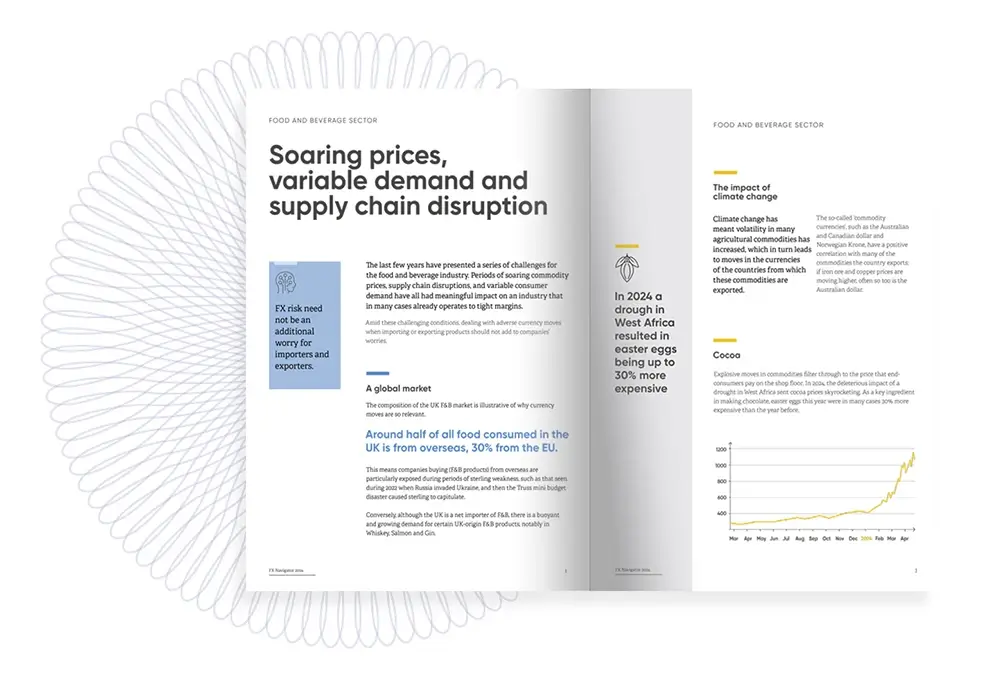

As finance teams set their budget rates in the lead-up to 2025, our experts weigh in on why it’s important to have one, how to arrive at the right rate for your business, and which macroeconomic factors to consider in the process.

A budget rate is an internal reference exchange rate set by organisations with international cash flows. Hedging strategies are used to protect the budget rate. Having an effective budget rate can improve your ability to forecast cash flows over a specific accounting period and effectively measure business performance.

To establish your business’ budget rate, first consider these two key principals:

- Attainability: Ensure that the rate you set is realistic and achievable.

- Objectivity: Stay informed. FX markets are influenced by many factors including macroeconomic events, monetary policy, geopolitical risk and black swan events. Therefore, it is hard to predict in which direction currency markets will move. For your budget rate to be effective, you need to keep a firm pulse on global events and market forecasts.

Fundamental drivers of currency moves

Many factors can impact currency markets. Here are the key drivers to consider in 2025:

- Monetary Policy: Much like in 2024, markets will remain focused on the timing and extent of interest rate cuts by major central banks. Divergence in such policy decisions drives volatility. Central banks remain reticent to engage in forward guidance regarding policy, preferring to be led by data to drive their decisions. For banks such as the Bank of England (BoE), for example, the need to see disinflation in the stubbornly high service sector is a key consideration for the rate cut cycle.

- US/UK/EU fundamental themes: In the US, the impact of Trump’s second term will be a key focus. The inflationary effect of his policies has already driven a stronger dollar in Q4 2024. To what extent will this continue in 2025? Will Trump ‘walk back’ some of his more extreme tariff threats? In the UK, sterling spent much of 2024 in impressive recovery mode, but GDP growth is slowing. UK businesses face a tough time in the wake of the Autumn budget, while UK consumers crave further rate cuts, which are likely to be delivered slowly and steadily across the year. In the Eurozone, structural issues in the German economy weigh on the single currency. US tariffs on Eurozone exports will compound these problems, alongside political turbulence in France and Germany.

- Rate cuts: Historical data indicates that previous Federal Reserve rate cut cycles, starting with a 0.5% reduction, have often been followed by significant equity market downturns. This raises the question of whether there are parallels between the current situation and past events, such as those in 2001.

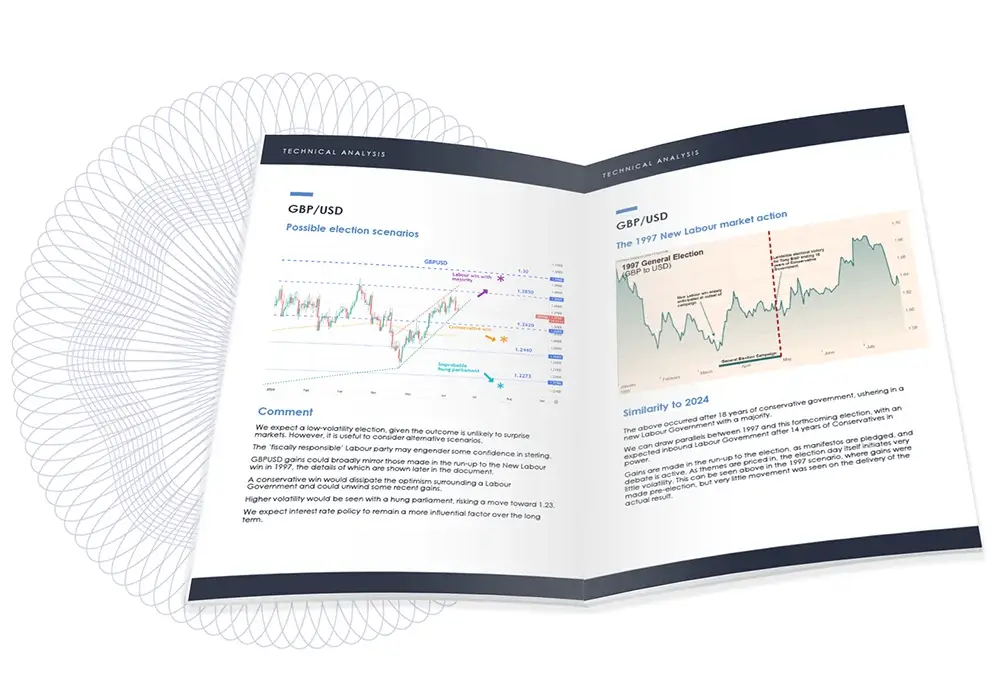

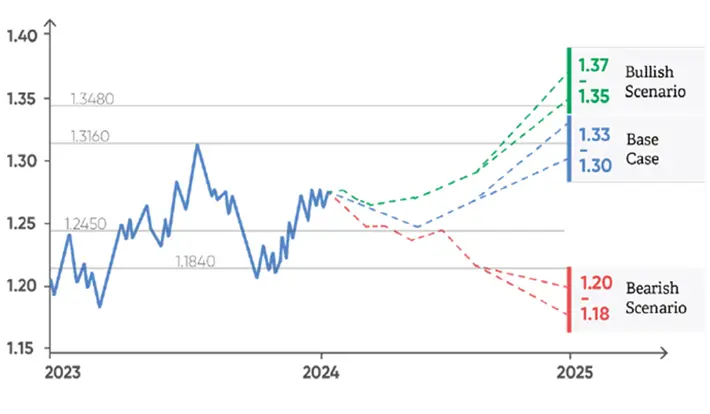

Scenario modelling

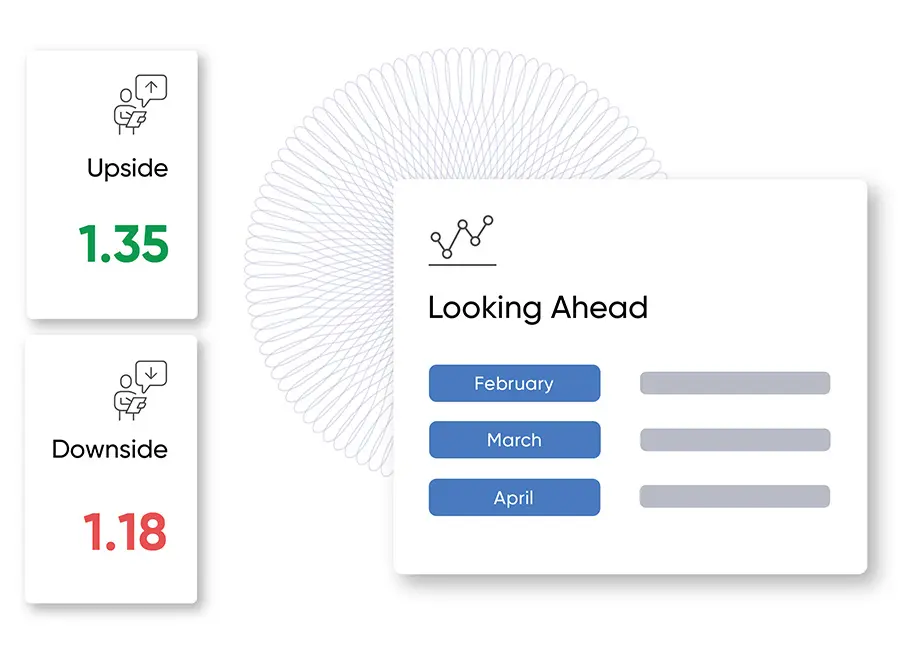

Outside of fundamental themes, when setting your budget rate, you need to create three broad scenarios to project where specific currency pairs might go and how this could potentially impact your business.

These broad scenarios are classed as:

- A bullish outlook, where one currency asserts itself over the other. Price action continues to drive higher in line with positive fundamental developments.

- The base case presents what you see as the likely path of price action given current fundamental expectations and volatility.

- A bearish scenario, where one currency weakens versus another, suffering declines in price action under the weight of negative fundamental and technical pressure.

Black swan and high volatility events are realities that your business can plan for. Adhering to rigid long-term perspectives is impractical, as emerging risk factors require swift and adaptive responses.

The right approach for your business

There is no one-size-fits-all formula when setting a budget rate and the way a business sets and achieves its budget rate will vary. Contributing factors include:

- Certainty over forecasting cash flows: How confident is your business about the cash flows its forecasting for 2025? Forecasts should be attainable and realistic.

- Risk appetite: Gauge the threshold of volatility and risk at which your business is willing to trade.

- Resources: Aside from large multinational corporations, most finance departments have limited resources and a vast remit. FX is only one of the many areas that teams need to manage. Be realistic about how often you can monitor and analyse your exposure, as well as execute ad-hoc trades.

Include FX hedging parameters in your Treasury Policy

How you approach your budget rate should also be determined by your FX hedging policy, which is an integral part of your wider treasury policy.

Don’t overcomplicate it. The best FX hedging policies are simple, brief and can fit onto a single page and ideally is updated annually. Below is an example of a typical structure that businesses use when creating or refreshing their treasury policy.

Split your FX hedging policy into five key sections:

1. Overview of your business’ FX exposure

What are you trying to achieve as a business and what problem are you trying to solve by creating this policy?

2. Objectives of your FX hedging policy

Protection of the budget rate and operating margins. Adhere to the set budget rate, protect operating margins and enable accurate forecasting.

- Certainty over your base currency costs and foreign currency exposure.

3. Parameters of your FX hedging policy

The parameters of your FX hedging policy outline how you operate within the capacity of your policy, and can be broken down into:

- The percentage of cash flow forecasts that can be hedged.

- The maximum tenor of trades. Establish the maximum length of FX contracts that you’re willing to commit to.

- The minimum FX exposure that is required to be hedged.

4. Authorised foreign exchange products

Selecting an appropriate combination of products will largely depend on your appetite for risk, resources, certainty over cash flow forecast and your business objectives.

Some businesses will opt for certainty, choosing predominantly forward contracts where the rate is set for a specific period. Others will prefer the flexibility to buy or sell currency when the market moves in a favourable direction.

The following products could be used either in isolation or in conjunction with others:

- Spot trades: Achieve competitive exchange rates for immediate transactions.

- Forward contracts: Lock in a rate today for exchange on a specific date up to four years ahead.

- Market Orders: Enhance your hedging strategy with market orders to buy and sell currencies when the market hits your desired rate.

- FX Options: Structured hedging solutions for qualifying businesses, offering both premium-based and zero-cost alternatives.

5. Authorised decision makers

List the job titles of team members that can authorise trades on behalf of your business.

Setting a budget rate can help your business effectively forecast cash flows and plays a crucial role in financial planning for the year ahead, allowing you to better measure your international business performance.

For more detailed guidance on how to set your budget rate, watch our webinar ‘Top 5 Considerations for Setting your 2025 Budget Rate.’

To find out how our team of FX experts can help guide your business’ budget rate and treasury policy, please contact us via [email protected].

Disclaimer: Argentex LLP is authorised and regulated by the FCA for the provision of the investment services, FRN 781007, and for the issuing of electronic money, FRN 900671. This document specifically refers to those services offered by Argentex that do not fall within the scope of investment services – spot contracts and forward contracts that meet the mean payment exclusion criteria as defined in the MiFID II regulations. Nothing contained in this document should be construed as advice, a personal recommendation or inducement to deal in any MiFID II designated financial instruments. www.argentex.com