Published date: 14 April 2025

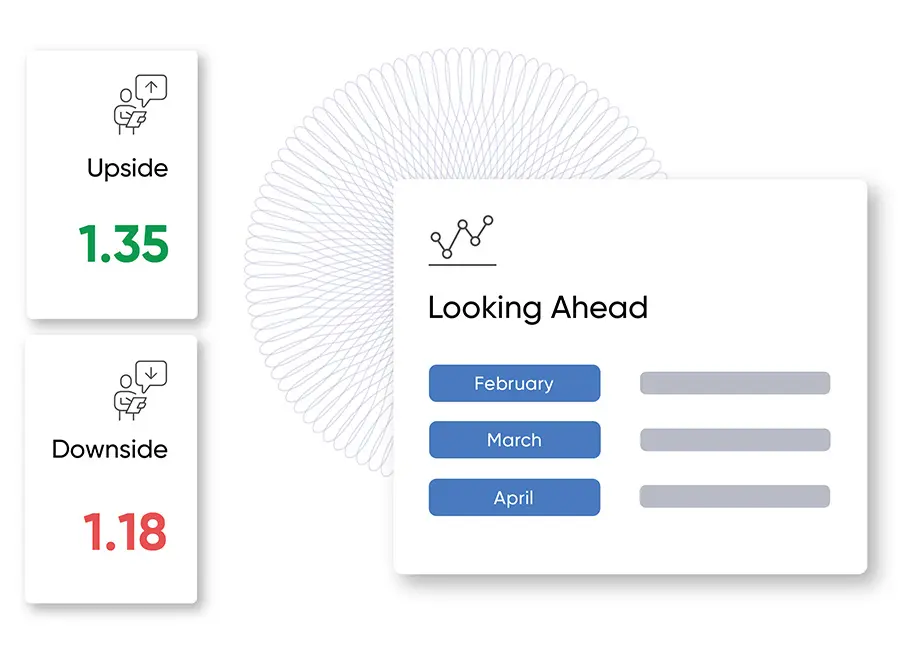

GBPEUR

Precipitous downside in GBP/EUR price action last week as inflows into the euro continued amidst turbulent cross-asset market action. Outflows from US equities and Treasuries made their way into safe-haven currencies (CHF, JPY, and increasingly EUR). Sterling, with a current account deficit and commensurate correlation to risk, tends to suffer in such scenarios.

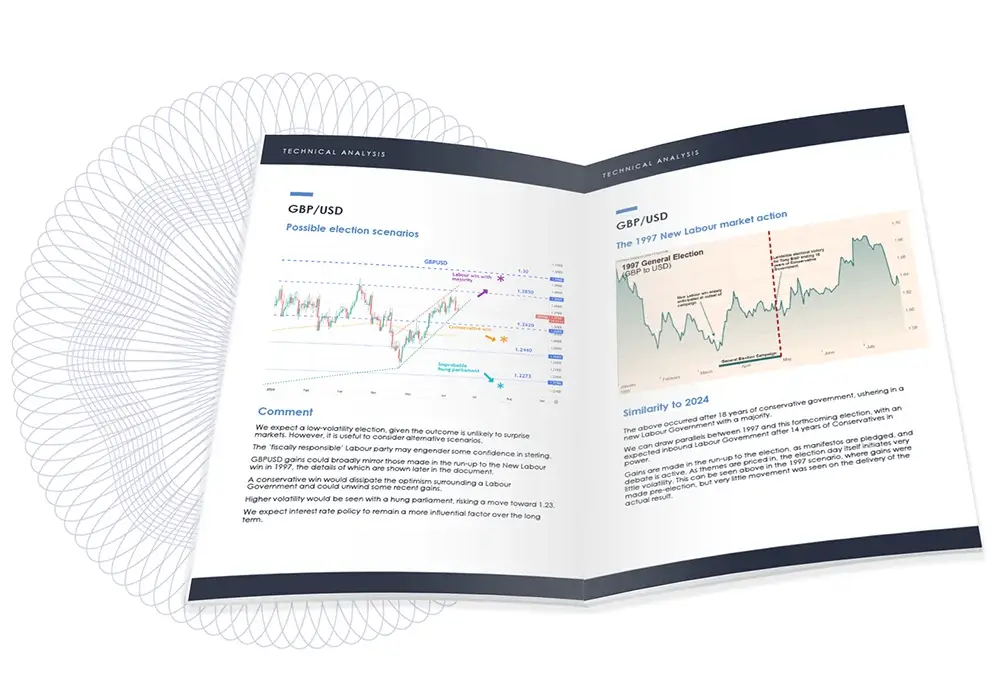

GBPUSD

With higher volatility permeating across markets, GBP/USD, after a sharp correction last week, is once again pushing higher as the market flees from US assets given the historic trade war escalation. Whilst the tariff/trade war saga remains the key driver, this week will also see UK inflation data released on Wednesday, with forecasts for headline inflation to have dropped to 2.7%.

EURUSD

The improving sentiment shift toward Europe, alongside concurrent rapidly deteriorating confidence in the US, has continued to play out dramatically in EUR/USD. Price action has nearly tested the major 1.15 level, and the gains made last week seem unlikely to be replicated in the near-term. Thursday’s ECB meeting and further trade war headlines will remain key drivers for the pair this week.