A look at recent developments and how these are impacting FX markets.

Fundamental developments

FX markets do not operate in a vacuum. When a fundamental sledgehammer strikes equity and bond markets, the impact on currencies can be pervasive, and, crucially, historical reaction functions can break down.

In general, markets are fixated on the impact of the trade war on economic growth (recession risks) rather than on inflation and central bank interest rate policy.

The tariff trade war has driven significant equity market downside and some sizeable spikes in bond yields. This is impacting FX markets, with some expected reactions—e.g., inflows into the safe havens of the Swiss Franc and Japanese Yen. Crucially, the dollar’s reaction function has changed.

A MAJOR shift in US dollar behaviour – what is going on?

Historically, in many cases, dropping equity markets and rising bond yields would be supportive of the dollar. However, there are some important developments we must understand that are different this time around:

- A negative shift in sentiment toward the US has resulted in weaker US equities and a weaker US Dollar, despite higher bond yields.

- Since COVID-19, there have been massive inflows into US equities and US Treasuries, which are now being unwound. This unwind results in the selling of dollar-based assets, which are now being partially directed elsewhere.

- For example, the radically improved investment case in Europe (post debt brake reform/defence/infrastructure fiscal package) means many investors are ‘rolling out’ of the US (and the dollar) and into Europe (and the euro).

- Once again, with such major structural shifts in play, the role of the dollar as the world’s ‘reserve currency’ is being called into question, adding to the duress the dollar is under.

- The trade war dynamics feed into the stagflation narrative of lower growth and stubborn inflation, putting central banks in a difficult position. However, dovish policy expectations for the balance of 2025 remain in place, moving toward the expected ‘neutral rate’.

Dollar dynamics continued…

- The dollar’s relationship with 10-year yields has broken down. Historically, the bond yield spread between Germany and the US would have meant EUR/USD would not have rallied sharply to the 1.13 levels it currently trades at.

- Much has been made of the fact that China is reducing its holdings of US Treasuries (bonds). This is clear, and they are diversifying away from the US. The dollar selling is largely occurring during the Asian session, which supports this theory.

- The current Trump regime is characterised by quick and aggressive changes in policy, as seen during last weeks’ tariff announcements, climb downs, and occasional mixed messaging between Trump, Bessent and Lutnick. This means that quick improvements in sentiment toward the US are possible, but in recent days, some equity market upside has not been joined by a meaningful dollar rally. This could change but remains a week-by-week dynamic.

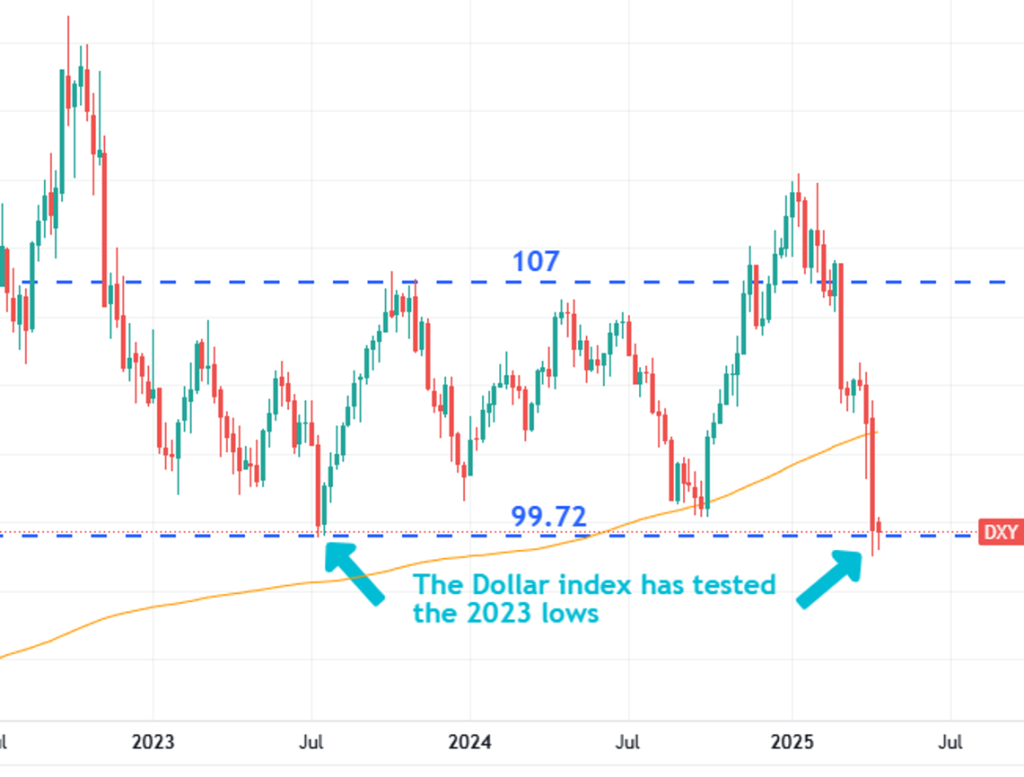

The dollar has now tested the 2023 lows at 99.72, which will act as a significant reference point for the market. The ongoing ability to hold here could expedite some closure of dollar shorts, facilitating a bounce. However, a break lower would be bearish, paving the way for further technical selling of USD. Short term, we favour the former scenario.

A look across the board

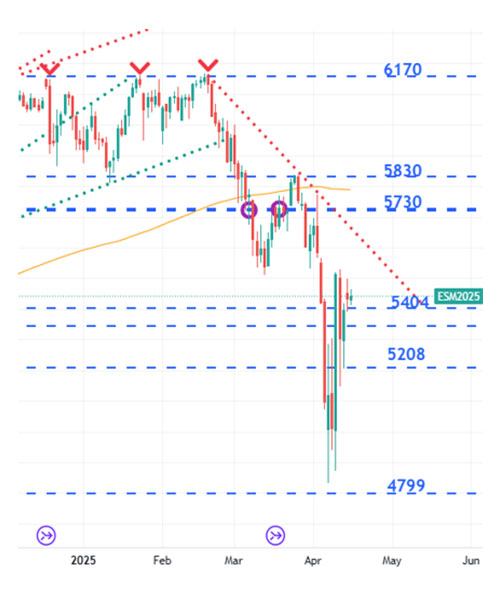

The decline in US equities has occurred alongside declines in USD. Over the last week, equities have rallied, while US 10-year Treasuries have sold off. This Treasury sell-off has occurred alongside further USD weakness, despite the rise in yields.

EUR/USD

Long-term EUR/USD analysis

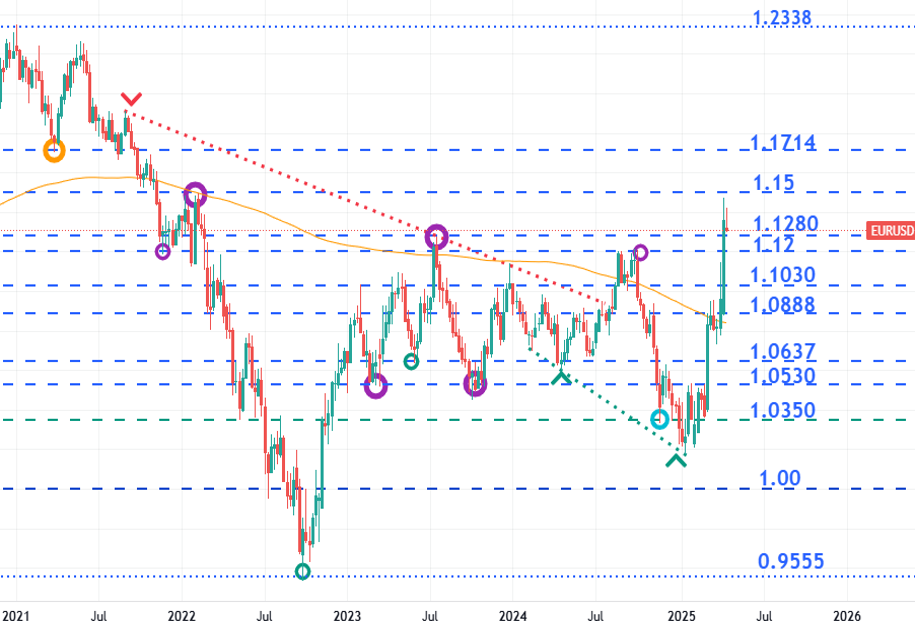

The break higher through 1.0530 occurred due to the huge fiscal reforms in the eurozone, alongside concurrent dollar selling pressure as confidence in US assets deteriorated.

The move is technically extended, with overhead upside resistance levels sat above the market at 1.15 and 1.1714. Both levels have historical technical validity beyond the timeframe illustrated above.

The balance of probabilities would lie with a near-term retracement, targeting 1.12 initially, followed by a deeper move toward 1.1030, especially if sentiment toward the US can improve, or an uplift in sentiment toward the US is manufactured by the Trump administration.

GBP/USD

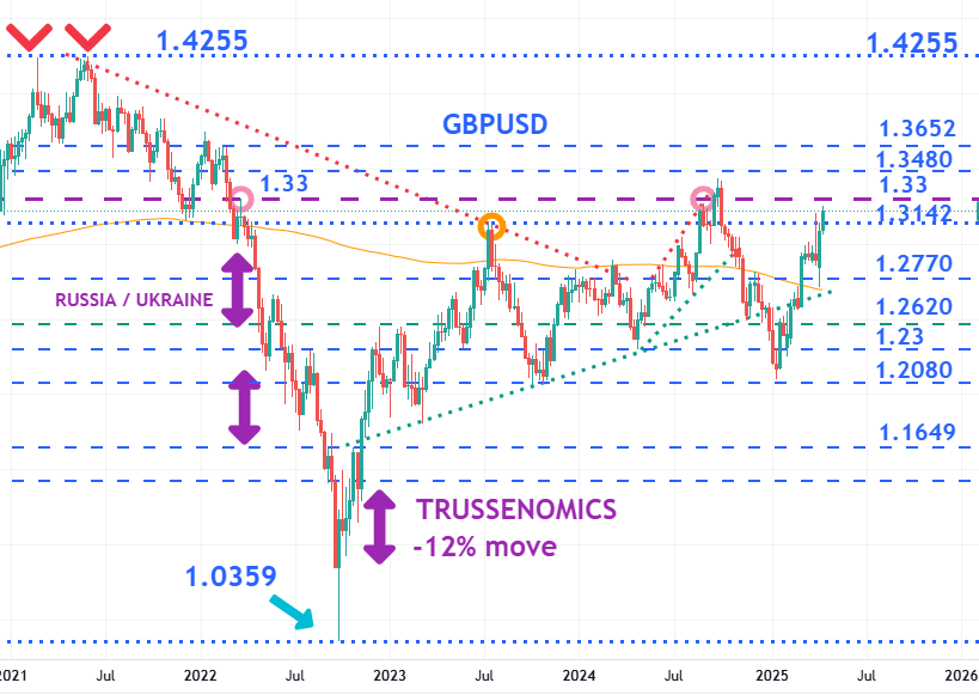

Long-term GBP/USD analysis

The breakthrough 1.2770 has facilitated a push toward 1.33.

1.33 is a long-term upside technical level that will be a key technical target for speculators who are long GBP/USD. A test of this level could act as an interim top to the current move higher.

In the event 1.33 is breached to the upside on a further leg of USD weakness, the clear technical target would be a move to 1.3480/1.3652, but we are of the view that this is not an immediate risk, especially as the DOLLAR INDEX is currently trying to bounce from the 2023 lows, as already illustrated in this document elsewhere. Our current view would be a retracement toward 1.3044 or further, should cross-asset volatility subside a little.

Longer term, sentiment toward the dollar will remain challenging if the current Trump ideologies remain in place. Any retracement in GBP/USD toward 1.27 is likely to be seen as a buying opportunity by market participants.

For more information about Argentex’s currency risk management and alternative banking solutions, please contact us on [email protected].