From shifting central bank policies to the economic ripple effects of Trump’s return, cautious optimism is tempered by uncertainties in Europe, China, and beyond.

This blog outlines some of the key macro themes set to affect currency markets for sterling, euro, and the US dollar. For a full and in-depth analysis, you can download our 15-page 2025 FX Navigator Report report.

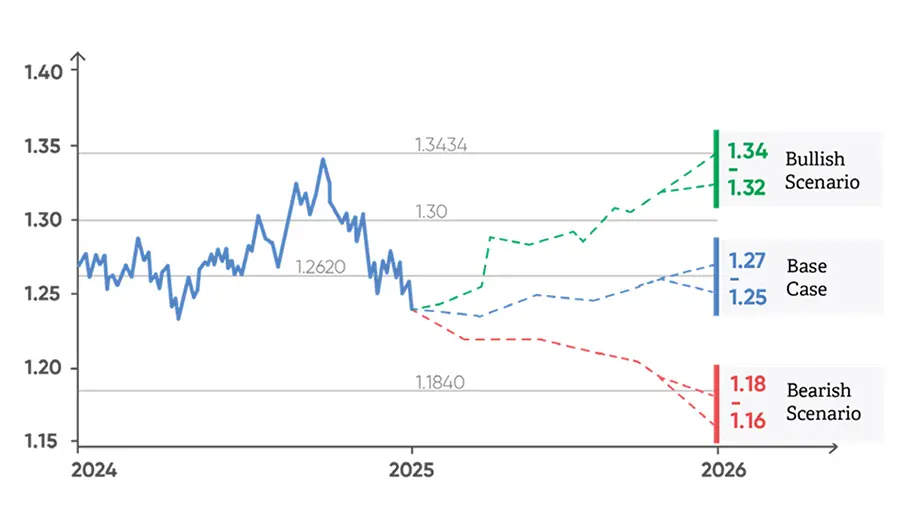

GBP

Sterling has been in recovery mode, but lately UK growth has been in decline, data is mixed, and the Labour government is struggling with low growth, spending cuts, high taxes, and limited fiscal space.

The long-term trajectory of the rate policy outlook is fluid; further cuts ranging from 0.25% to 1.25% are possible in 2025.

Gilt yield rises remain a background concern, while GDP growth estimates vary from 1% to 2%.

Alternatively, Labour policies could dampen business confidence, high borrowing costs could squeeze consumers, and persistent inflation could prevent the Bank of England from cutting rates, creating mixed signals for the pound.

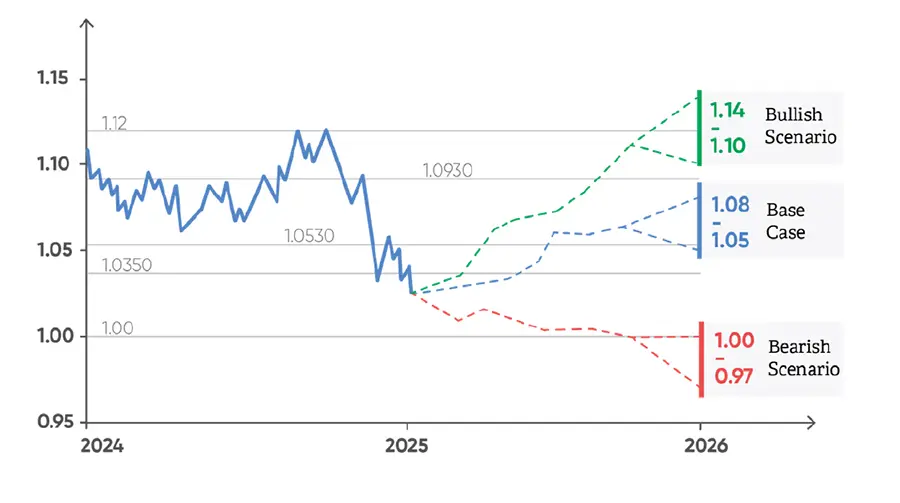

USD

After a summer dollar sell-off due to weak US data (poor Non-Farm Payrolls, weak PMIs) and expectations of aggressive Federal Reserve rate cuts, the dollar rebounded in Q4 2024 due to Trump policies, a less dovish Federal Reserve, and solid US economic data.

Future market focus remains on Trump tariffs, immigration, tax, Ukraine, and debt ceiling issues.

The US President drives market volatility with controversial rhetoric, Federal Reserve policy meddling, and aggressive policies.

If the Federal Reserve barely cuts rates in 2025 and US data remains strong, dollar weakness is unlikely in the first half or all of 2025.

A bearish dollar view depends on further rate cuts later in the year, alongside less robust US data, and a more conciliatory Trump.

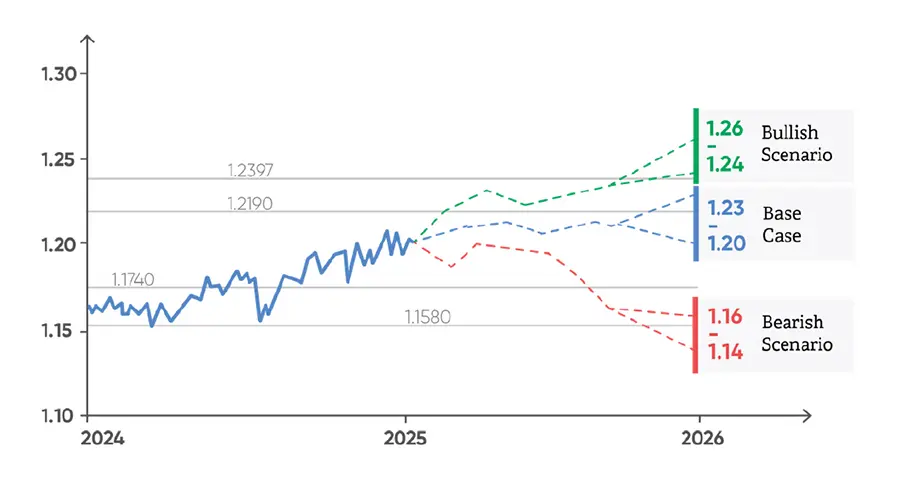

EUR

The expectation of US tariffs on eurozone exports and reduced trade with China are weighing on the euro.

There is potential for further euro weakness, but possible recovery later in the year if the ECB cuts less than expected, Trump tariffs are smaller, and political situations in France and Germany improve.

For more information about Argentex’s payments and currency risk management solutions, please contact us on [email protected].