This article was first published in GTM Global

As ambitious UK and European tech and digital scaleups set their sights on conquering the lucrative US market, they face a critical challenge – managing the complexities of foreign exchange (FX). Currency fluctuations can make or break your expansion plans, impacting everything from profit margins to cash flow stability.

But with the right strategic FX approach, you can turn this challenge into a competitive advantage. That’s where GTM Global’s partner Argentex comes in. As a leading provider of FX solutions, Argentex has helped numerous scale-ups like UK tech sensation Popsa achieve their international growth targets through a robust FX strategy.

The Perils of Unmanaged FX Risk

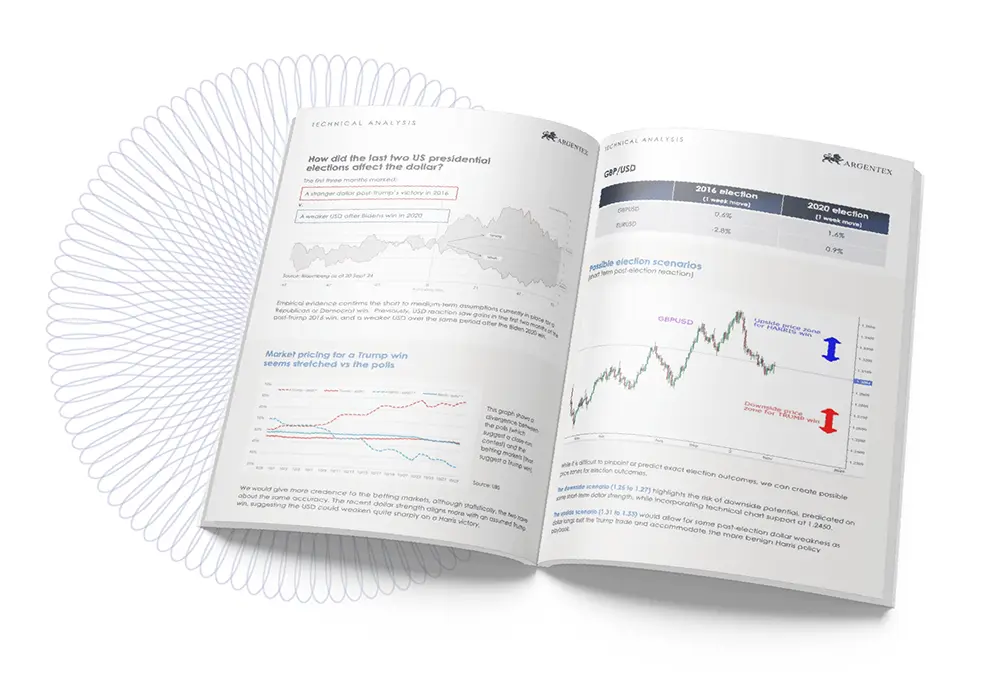

Expanding into the US market opens up immense opportunities, but also significant FX risks. Volatile exchange rates can quickly erode your profit margins, especially if you’re dealing with supplier and customer payments in different currencies. Unexpected swings in the GBP/USD or EUR/USD can also wreak havoc on your cash flow, making it difficult to accurately forecast and manage your finances.

“Unmanaged FX exposure is one of the biggest threats facing scale-ups looking to grow internationally,” says Joe Duffelen, Director at Argentex. “Even a relatively small, unfavourable move in the exchange rate can have a significant impact on your bottom line”.

The stakes are even higher for subscription-based or recurring revenue business models, where FX volatility can create unpredictable variances in your income stream. Without a strategy to mitigate these risks, your expansion plans could be derailed. Argentex’s client Popsa, a fast-growing UK photo book app, experienced this first-hand.

“Internationalisation is at the core of our business. Robust foreign exchange hedging strategy helped the business achieve its international growth targets.”

Declan Mellett

Chairman, Popsa

Beyond Payments: Navigating FX Complexities

Your FX management considerations extend far beyond just customer and supplier payments. As you expand into the US, you’ll likely need to navigate a range of other currency-related transactions, each with its own set of risks and challenges.

Receiving investment or financing in a foreign currency, for example, can create significant FX exposure if not managed properly. Repatriating funds to pay for overseas staff, regional creditors, or other operational costs also requires careful planning to ensure your cash flow remains stable.

Strategically, having a sound hedging policy in place can also give you greater negotiating power when it comes to securing longer contract periods with suppliers and partners. By demonstrating your ability to manage currency risks, you may be able to secure more favourable terms that further boost your profit margins.

“It’s about taking a holistic view of your FX profile and putting in place a comprehensive risk management strategy,” explains Duffelen. “This gives you the confidence and flexibility to navigate all aspects of your international expansion, from financing to operational expenses.”

Mastering FX for Sustainable Expansion

The good news is that there are effective ways to manage FX risk and turn it into a strategic advantage. By partnering with a specialist provider like Argentex, you can implement a holistic FX management strategy tailored to your business needs.

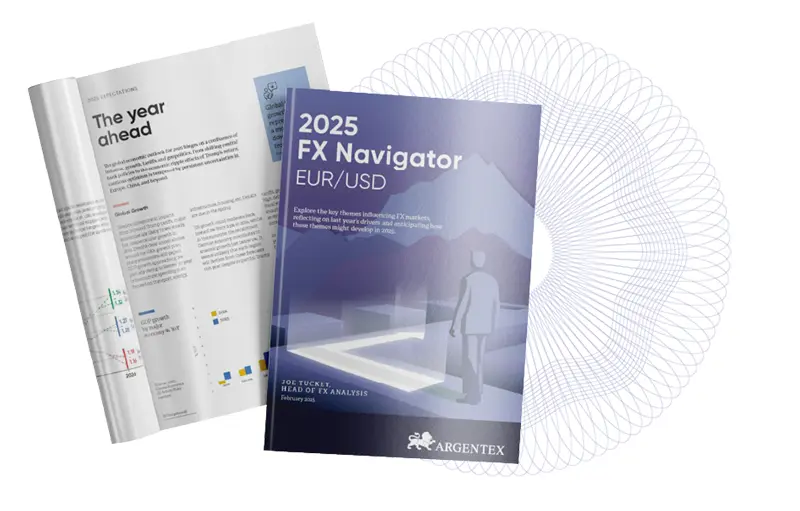

“It’s not just about buying the right hedging products,” says Duffelen. “It’s about truly understanding your FX exposure, forecasting your currency requirements, and developing a comprehensive risk management plan that aligns with your expansion goals.”

Argentex’s approach starts with a detailed analysis of your FX profile – examining your revenue streams, supplier/customer payments, and future growth plans. They then design a customised FX strategy, which may include tools like forward contracts, options, and spot trades to lock in favourable rates and stabilise your cash flow.

Importantly, Argentex provides ongoing support and guidance, adjusting your FX plan as your business evolves. “It’s a collaborative, consultative process,” explains Duffelen. “We work closely with our clients to ensure their FX strategy remains effective and agile, enabling them to confidently navigate currency market volatility.”

Unlocking the US Opportunity

Ultimately, effective FX management is not just about risk mitigation – it’s about unlocking your full growth potential. By proactively managing currency fluctuations, you can confidently invest in your US expansion, secure in the knowledge that your profit margins and cash flow are protected.

“The US market represents an incredible opportunity for UK and European scaleups, but navigating the FX landscape is critical. That’s why we’re proud to partner with Argentex – they provide the expertise and strategic support our clients need to succeed on the global stage.”

Mark Stimpfig

CEO, GTM Global

So, as you set your sights on the lucrative US market, don’t let currency challenges hold you back. Embrace a strategic FX management approach, and unlock a world of growth and opportunity.

To find out how our team of FX experts can support your business’ currency risk management requirements, please contact us via [email protected].