In this interview, Argentex BV’s Managing Director Jorn Andriessen discusses the hurdles CFOs face across Europe, why private equity firms should secure longer-term hedging strategies and how corporates can safeguard their profit margins against currency moves.

What’s keeping Dutch CFOs up at night and how can Argentex help them?

Undoubtedly, the current landscape is as precarious as it is challenging for CFOs working to preserve margins. With increasing interest rates and inflation at peak levels across Europe, there’s no shortage of events keeping CFOs up at night. Navigating currency risk is often seen as a tedious administrative task or noise, however critical it may be. The CFO of today and tomorrow must be able to analyse financial data and apply it to operational decision making and strategy. As the amount of market data increases, organisations have access to actionable insights. There is a caveat to this— businesses require a dedicated resource to manage the information. Argentex acts as an invisible addition to the treasury team, consulting on the impact of interest rates, currency and translation risk on your business. Our experts offer in-depth analysis and will notify your business of the market fluctuations that matter to you as and when they happen, allowing CFOs and their teams to focus on the numerous other affairs impacting their resources, operations and bottom line.

What specialised services do you offer to funds and private equity?

Private equity firms and trusts often struggle to meet the risk threshold of traditional banks. Even those that are regulated and licensed find it difficult to access financial products. Lacking risk appetite, banks shy away from providing bank accounts, either completely denying access or stretching out the onboarding processes over months. During unfeasible waiting times, private equity firms, who operate under pressing time constraints, fall victim to delayed or failed investment opportunities. Unwilling to wait on processing times, investors are prone to abandoning projects altogether. Institutional investment is a fast-paced environment that is particularly perilous, and it is imperative that businesses operating in this capacity have access to speedy and efficient payments.

Adding a layer of complexity, banks are prone to offering shorter-term contracts, avoiding agreements that are longer than twelve months. Whilst the tide is slowly turning, banks largely focus on standardised products. And whilst this may suit certain organisations, Argentex has found its niche catering to those that are seeking a bespoke strategy and flexibility. Clients benefit from longer-term hedging strategies without the cost related to credit facilities and efficient onboarding.

You also facilitate large corporations. What advice would you offer to corporations looking to refine their hedging strategies/treasury policy?

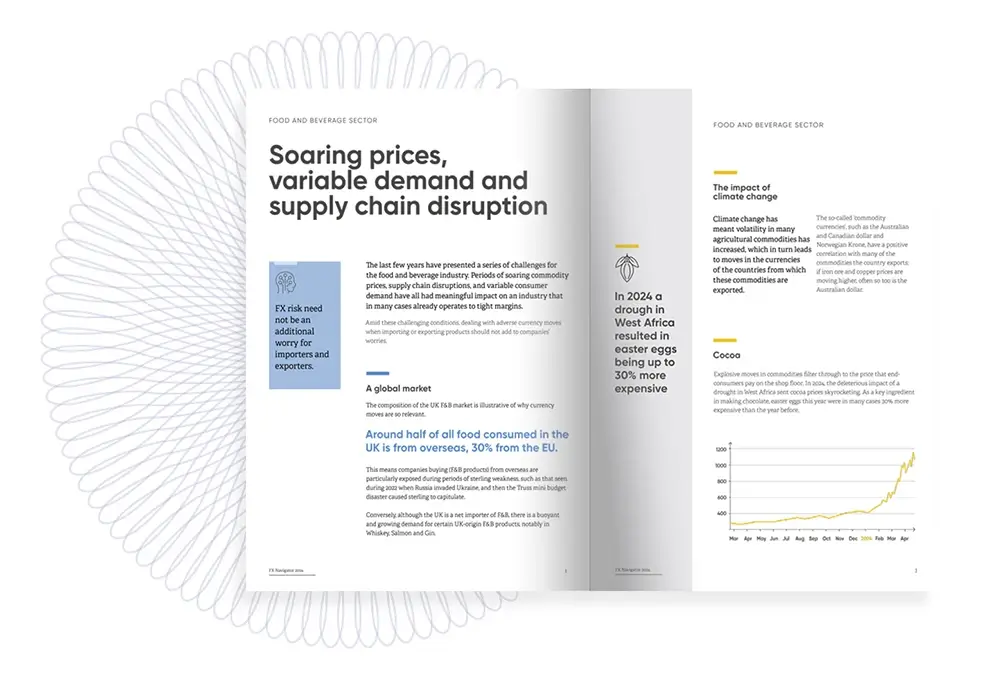

With fluctuations in global trade, the headache of inflation and interest rates on the rise, businesses are feeling the effects of the cost-of-living crisis. Companies are now faced with the very real dilemma of refinancing their portfolios. Safeguarding your profit margins against undesired currency moves has never been so crucial. CFOs need to ensure they have the right amount of flexibility within their hedging products and Argentex is well placed to align bespoke strategies to ensure businesses can realise their profit margins in times of market volatility.

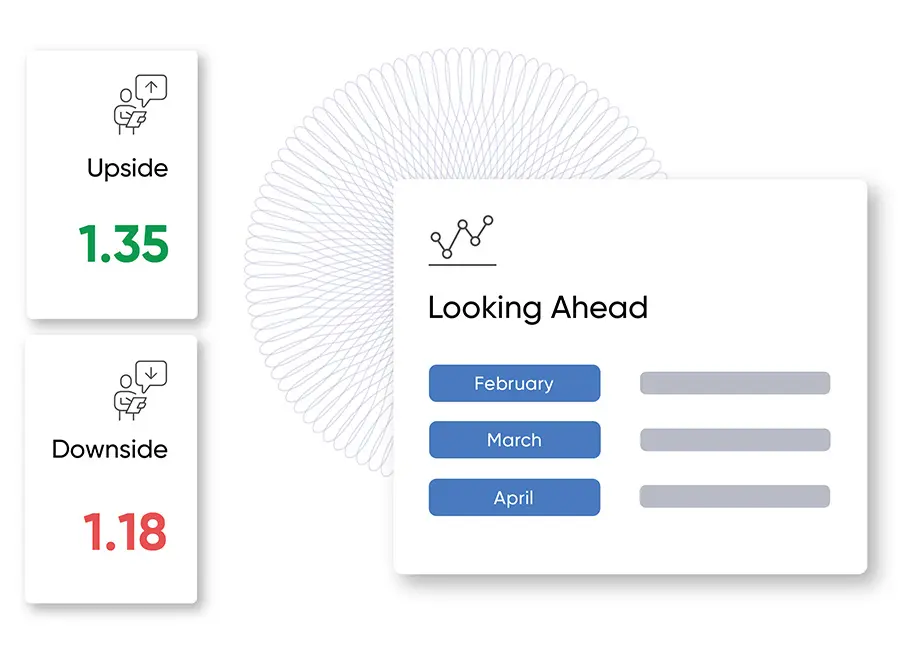

How can you help companies with long-term projects visualise their cash flow forecasts against milestone payments?

A business’s forecast is only as good as the data it’s based on. Coupling a bespoke hedging strategy with your cash flow forecast is essential to ensure you don’t fall victim to the spot market which could offer unfavourable rates. Flexibility is key for organisations wanting to safeguard their profit margins, but unnecessary levels can be costly. Building windows around milestones, Argentex can help businesses safeguard the proceeds and costs allocated to a project by locking in a competitive rate.

Jorn Andriessen

A dynamic leader with over 15 years of experience in commercial FX roles, Jorn has spearheaded regional growth and brand visibility for Argentex BV since joining as Managing Director in January 2020. As a result- driven FinTech, banking and financial markets specialist, Jorn brings to the company in depth knowledge of the currency risk landscape as well as extensive experience delivering sales strategies to drive revenue, attract and maintain customers and build a solid brand. With a keen eye for new business opportunities, Jorn also possesses strong interpersonal and communication skills, making him a great asset to the senior leadership team at Argentex BV.

Jorn has demonstrable experience across financial markets, previously holding senior leadership positions with Ebury, Western Union and FIRMA Foreign Exchange.

For more information about Argentex’s payments and currency risk management solutions, please contact us on [email protected].